Welcome to the FGMR website!

Having published my paid subscription newsletter from 1987 to 2009, I am pleased to now offer my commentaries, market insights and more in this free, online report – the Free Gold Money Report.

My objective is to share with you my views on gold, which in recent decades has become one of the world’s most misunderstood asset classes. This low level of knowledge about gold creates a wonderful opportunity and competitive edge to those who truly understand gold and money. It is my aim to help everyone – whether you are a novice investor or an experienced trader – who follows these commentaries to take advantage of the opportunity gold offers.

I approach the gold market from the perspective of a long-term investor who views gold as money and is accumulating gold as a form of savings to protect my purchasing power.

WHY ACCUMULATE GOLD?

Everyone needs some savings, whether for a ‘rainy day’ or to build up some cash prior to making a purchase or an investment. Given these purposes and particularly the importance of having a ‘nest egg’ to protect you and your family from an uncertain future, never put your savings at risk. Unfortunately, this important principle is often overlooked today in two different ways.

First, there is counterparty risk. Wealth comes in two forms – tangible assets and financial assets. When you own a tangible asset, like physical gold, there is no counterparty risk. The usefulness of the tangible asset is not dependent upon any counterparty, in contrast to financial assets, all of which have counterparty risk. For example, the money you have in a bank is only as good as the financial capacity of the bank or the government guaranteeing that deposit to return your money to you when you choose to spend it or ask for it in cash.

Broken promises to repay obligations cause financial crises. These are recurring events throughout banking history, the latest being the 2007-2009 crisis which saw the collapse of banks and economic activity. Given the excessive number of financial promises issued in recent decades, counterparty risk has grown substantially

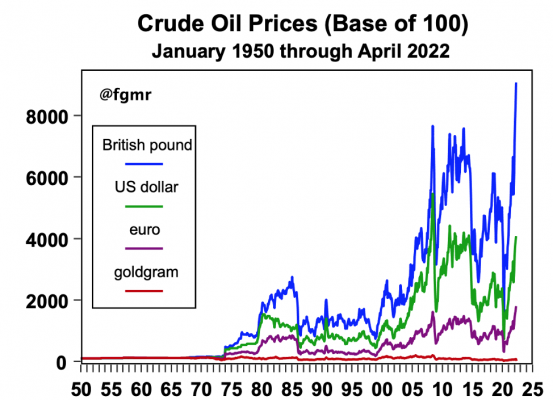

Second, there is purchasing power risk, namely, that the value of your savings declines because of inflation. To assess the extent of this loss, do not measure your savings in terms of dollars, euros, pounds, or any other national currency. Measure your savings in terms of purchasing power. The following chart illustrates this point.

Crude oil is becoming more expensive when its price is measured in terms of dollars and other national currencies. But the price of crude oil is essentially unchanged since 1950 when its price is measured in terms of gold. Had the gold standard not been abandoned in 1971, nobody today would be talking about the rising price of crude oil simply because the price of crude oil would not be rising.

There are some important points to make from the above long-term chart. Gold has appreciated against all the world’s currencies, or in other words, the purchasing power of all the world’s currencies has depreciated relative to gold’s purchasing power. National currencies are not a safe-haven and not worthy of your savings.

Gold is often accused of being volatile. In fact, in a world of fiat currencies backed by nothing but government promises, the volatility comes when prices are measured with national currencies. The currencies bob up-and-down relative to each other but are sinking relative to gold – at different rates. In the above chart, as bad as the dollar has been, the British pound is worse because it has lost even more purchasing power.

Thus, gold best meets the needs for saving money. Physical gold does not have counterparty risk, and gold preserves purchasing power over long periods of time.

CONCLUSION

I have put the above insights about gold and money into practice. In 2001 I founded a company, Goldmoney, to help you accumulate physical gold, silver, platinum, and palladium.

My objective and my hope are that the information in this website will be helpful to you in making sound financial decisions to prepare for the future.

My objective is to share with you my views on gold, which in recent decades has become one of the world’s most misunderstood asset classes. This low level of knowledge about gold creates a wonderful opportunity and competitive edge to everyone who truly understands gold and money.

My objective is to share with you my views on gold, which in recent decades has become one of the world’s most misunderstood asset classes. This low level of knowledge about gold creates a wonderful opportunity and competitive edge to everyone who truly understands gold and money.